Embarking on the journey to financial freedom can feel daunting, especially when faced with the complexities and noise of the investment world. Many start with enthusiasm, perhaps dabbling in trading or chasing hot stock tips, only to find themselves stressed, confused, or worse, losing valuable time and money. But what if there was a clearer, more sustainable path to building substantial wealth? A path focused not on frantic activity, but on discipline, patience, and a long-term perspective?

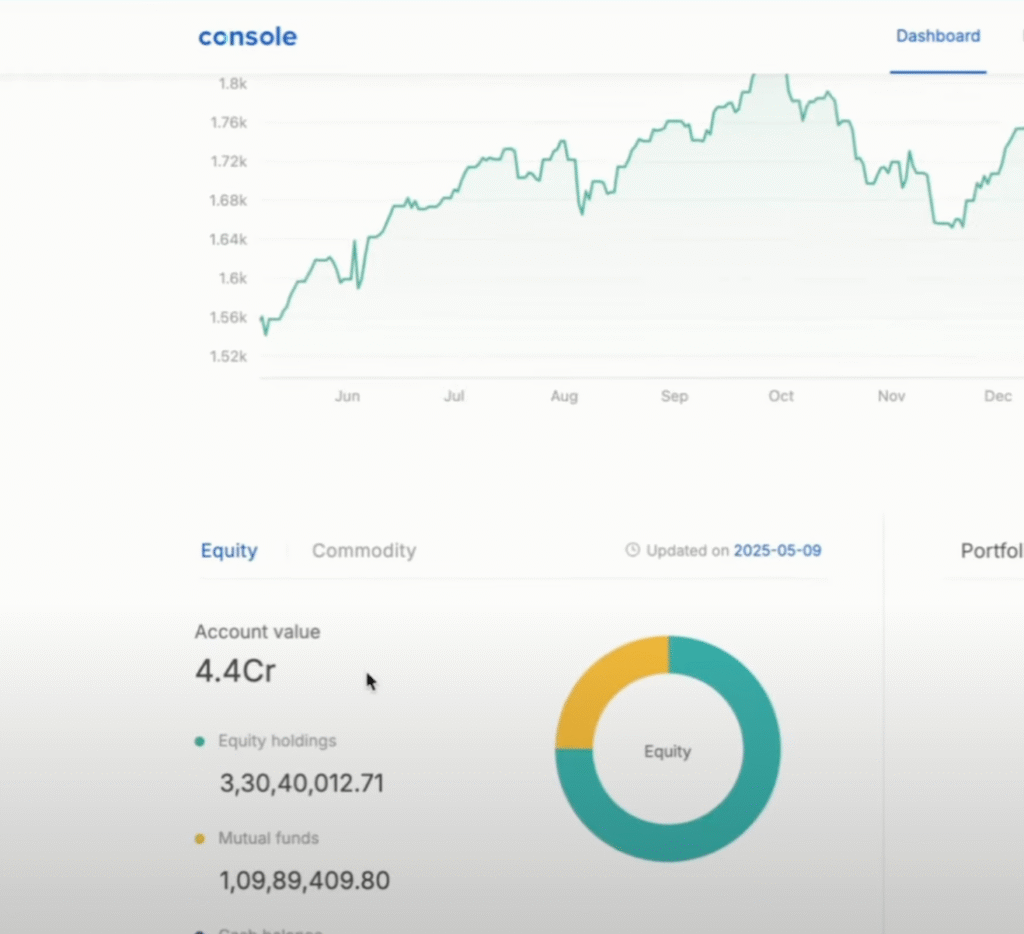

This guide delves into a philosophy of building a “Freedom Portfolio” – a substantial investment corpus designed to provide financial independence and peace of mind. It draws from the real-world experience of shifting from the allure of trading and market timing towards a more grounded, passive investment strategy, particularly after life-changing events like becoming a parent highlighted the true value of time. The core idea? Life is richer than charts and research; true wealth includes the freedom to live it fully.

This approach led to the development of 10 essential rules, principles honed through experience, focusing on leveraging the power of the market through simple, low-cost tools like index funds, while consciously avoiding common pitfalls. These rules aren’t about complex financial wizardry; they are about establishing a robust, automated, and stress-free system that allows your wealth to grow steadily over time, freeing you to focus on what truly matters. Let’s explore these 10 foundational rules for building your own Freedom Portfolio.

Rule 1: Do NOT Trade. Invest for the Long Term.

The siren call of trading – buying and selling frequently in hopes of quick profits – is incredibly tempting, especially when starting out. The potential for rapid gains seems exciting. However, experience often teaches a harsh lesson: trading is less about skill and more about luck and timing, factors notoriously difficult to master consistently. While short-term trading might yield occasional wins, it rarely builds sustainable, long-term wealth. More importantly, it consumes your most valuable resource: time.

The shift away from trading towards long-term investing isn’t necessarily driven by loss aversion, but by a desire to reclaim time and mental energy. Long-term investing harnesses the power of compounding, allowing your money to grow exponentially as returns generate further returns. It minimizes the drag of frequent transaction costs and taxes that eat into trading profits. Crucially, it frees you from the constant need to monitor markets, reducing the anxiety tied to daily fluctuations and the pressure of making split-second decisions.

Adopting a long-term perspective means trusting the overall growth trajectory of the market. Instead of trying to pick individual winners or time market peaks and troughs, focus on participating in the market’s broad progress through diversified, low-cost vehicles like index funds (tracking indices such as NIFTY 50, NIFTY NEXT 50, or MIDCAP 150). Make a conscious decision to ignore the daily noise of market news and stock tips, which often fuel emotional reactions rather than rational planning. Stick to your long-term plan, confident in the market’s historical resilience and ability to recover from inevitable downturns. Trading is a high-stress, high-risk activity; long-term investing is a disciplined path to building lasting wealth and achieving true financial freedom.

Rule 2: Invest Passively

Complementing the long-term approach is the principle of passive investing. This stands in contrast to active investing, which involves constantly researching, buying, and selling individual stocks or relying on fund managers who attempt to outperform the market. While active management promises superior returns, the reality is often disappointing. It’s time-consuming, stressful, and statistically, most active managers fail to consistently beat their benchmark indices, especially after accounting for their higher fees.

Passive investing, typically executed through index funds or Exchange-Traded Funds (ETFs), embraces a simpler philosophy: instead of trying to beat the market, aim to match its performance. This strategy offers several compelling advantages. Firstly, costs are significantly lower. Index funds simply replicate an index, requiring minimal management and thus incurring much lower expense ratios compared to actively managed funds. Over decades, this cost difference compounds significantly in your favor.

Secondly, passive investing provides diversification automatically. An index fund holds all the securities in its underlying index, spreading your risk across hundreds or even thousands of companies. This inherent diversification cushions the impact of any single company’s poor performance.

Thirdly, it promotes consistency. While active strategies can lead to volatile swings, index funds tend to deliver returns that closely mirror the overall market, providing a steadier path for long-term wealth accumulation. Perhaps most importantly, passive investing removes the emotional rollercoaster and the need for constant vigilance. You can largely “set it and forget it,” automating your investments through tools like Systematic Investment Plans (SIPs) and trusting the process. This frees up immense mental bandwidth and reduces stress, allowing you to focus on other life priorities. While you might still allocate a small portion of your portfolio to individual stocks if you enjoy the process, the core of a Freedom Portfolio should be built on the reliable, low-cost, and stress-free foundation of passive investing.

Rule 3: Do NOT Follow Market News or Stock Advisors

In today’s hyper-connected world, we are constantly bombarded with financial news, expert opinions, and stock tips. Turn on a business channel, browse a financial website, or scroll through social media, and you’ll find endless predictions, analyses, and “hot picks.” When starting the investment journey, it’s natural to seek guidance, but relying heavily on market news and stock advisors can be counterproductive and even detrimental.

The financial media often thrives on sensationalism and short-term narratives. Headlines are designed to grab attention, frequently highlighting market volatility, potential crashes, or fleeting trends. This constant stream of often contradictory information can induce fear during downturns and greed during upswings, leading to emotional, irrational investment decisions like panic selling or chasing speculative bubbles.

Stock advisors, while sometimes well-intentioned, also present challenges. Different advisors often have conflicting opinions and strategies. Following multiple sources can lead to confusion, indecision, and analysis paralysis. Furthermore, advisors may have their own biases or incentives that don’t perfectly align with your long-term goals. The sheer volume of noise makes it incredibly difficult to filter out valuable signals and easy to lose sight of your own strategic plan.

A core tenet of building a Freedom Portfolio is to tune out this noise. By adopting a passive, long-term strategy centered on diversified index funds, you anchor your decisions in the fundamental belief in the market’s long-term growth potential, rather than reacting to short-term headlines. Make a conscious effort to limit your exposure to daily market commentary and resist the urge to act on tips or predictions. Trust your pre-defined plan, stay disciplined with regular investments (like SIPs), and let the market’s long-term trajectory work for you. This approach not only leads to more consistent results but also significantly reduces investment-related stress and anxiety.

Rule 4: Do NOT Try to Beat the Stock Market

Many investors, particularly those new to the market, harbor the ambition of “beating the market” – achieving returns significantly higher than the overall market average. This desire is often fueled by stories of successful traders or high-performing active funds. However, consistently beating the market over the long term is an incredibly difficult, if not impossible, feat for the vast majority of investors, including professionals.

The pursuit of market-beating returns often leads investors down the path of active trading, complex strategies, or chasing high-risk investments. This requires immense time, effort, expertise, and a significant tolerance for stress and potential losses. More importantly, fixating on beating the market can distract from your actual financial goals.

The objective of investing shouldn’t be arbitrary outperformance relative to an index; it should be about achieving your specific financial objectives – whether that’s accumulating enough for a comfortable retirement, funding education, buying property, or simply growing your wealth at a rate that significantly outpaces inflation (e.g., targeting a realistic long-term return like 15% CAGR).

Comparing your portfolio’s performance to the market index every day or month is often unhelpful and can lead to unnecessary anxiety or impulsive actions. Instead of dedicating countless hours to researching stocks and analyzing charts in an attempt to gain an edge, redirect that energy towards more productive activities. Focus on increasing your active income through career growth or developing new skills. The additional capital generated can then be channeled into your consistent, passive investment plan, likely having a far greater impact on your long-term wealth than trying to eke out an extra percentage point over the market.

Shift your mindset from competition against the market to progress towards your personal goals. Embrace a strategy that ensures participation in market growth through low-cost, diversified funds, and focus your active efforts on enhancing your earning potential. This approach is not only less stressful but also statistically more likely to lead to long-term financial success.

Rule 5: Do NOT Invest in Actively Managed Large-Cap Funds

When constructing the equity portion of a portfolio, investors often consider actively managed mutual funds, especially in the large-cap space (funds investing in the largest companies). These funds are run by professional managers who actively select stocks, aiming to outperform a benchmark index like the NIFTY 50. The appeal lies in the potential for higher returns driven by expert stock picking.

However, a closer look at historical data and costs reveals significant drawbacks. Actively managed large-cap funds consistently struggle to outperform their passive counterparts (index funds) over the long term, especially after accounting for their higher fees. The reasons are multifaceted. Firstly, large-cap stocks are heavily researched and efficiently priced, making it difficult for managers to find undervalued opportunities consistently. Secondly, active management involves frequent trading, research teams, and higher manager salaries, all contributing to significantly higher expense ratios compared to passive index funds.

These higher fees act as a constant drag on performance. Even if an active fund manager has a period of outperformance, the higher costs often erode much of the excess return. Over many years, the compounding effect of these higher fees can lead to substantially lower net returns for the investor compared to simply holding a low-cost large-cap index fund.

Given this evidence, investing in actively managed large-cap funds rarely makes sense for the long-term passive investor. The potential for marginal outperformance is often outweighed by the certainty of higher costs and the statistical likelihood of underperformance. A more prudent approach for large-cap exposure within your Freedom Portfolio is to utilize low-cost index funds or ETFs that track broad large-cap indices like the NIFTY 50 or NIFTY Next 50. This ensures you capture the market return for this segment reliably and cost-effectively, aligning perfectly with the passive, long-term philosophy.

Rule 6: Do NOT Invest in Small-Cap Index Funds or ETFs (Not a strict one!)

While index funds are generally the preferred vehicle for large-cap and even mid-cap exposure, the small-cap segment of the market presents a different dynamic. Small-cap companies (those with smaller market capitalizations) offer significant growth potential but also come with higher volatility and unique risks. In this specific area, the argument for passive investing through index funds or ETFs becomes less compelling, and actively managed funds often have an edge.

Why the distinction? Small-cap index funds face several challenges. The universe of small-cap stocks is vast and less researched than the large-cap space. Passive index funds, by definition, must buy all stocks in the index, including potentially lower-quality or poorly performing companies. They may also struggle with liquidity issues when buying or selling shares of smaller, less-traded companies, which can increase costs (impact cost) and tracking errors (deviation from the index performance).

Furthermore, the potential for skilled active managers to add value is arguably greater in the less efficient small-cap market. Experienced managers can conduct in-depth research to identify promising small companies with strong growth prospects that might be overlooked by the broader market or not yet included in an index. They can navigate the higher volatility and potentially generate superior returns by actively selecting winners and avoiding losers within the small-cap universe.

Historical data in many markets, including India, often shows that a higher proportion of actively managed small-cap funds manage to outperform their respective benchmark indices compared to their large-cap counterparts. Therefore, when allocating to small-caps within your Freedom Portfolio, consider using actively managed small-cap mutual funds run by reputable fund houses with proven track records in this space. While index investing forms the core for large and mid-caps, a selective approach using active management can be more effective for harnessing the growth potential of small-cap stocks.

Rule 7: Create Your Overall Portfolio Split (Asset Allocation)

A cornerstone of sound investing is establishing a clear asset allocation strategy – deciding how to divide your investments across different asset classes (like equity, debt, real estate, gold) and within asset classes (like different market caps or geographies in equity). This overall portfolio split is arguably more important for long-term returns and risk management than the selection of individual investments.

Your ideal asset allocation depends on several personal factors, including your financial goals, investment time horizon, and risk tolerance. There’s no single

‘one-size-fits-all’ solution. However, a well-thought-out allocation provides structure and discipline.

A common approach involves diversifying across major asset classes. For the equity portion, further diversification across market capitalizations (large-cap, mid-cap, small-cap) and geographies (domestic vs. international) is crucial. A sample equity allocation, as mentioned in the source material, could be:

•Large-Cap (e.g., 30%): Primarily through low-cost index funds tracking indices like NIFTY 50 and NIFTY NEXT 50.

•Mid-Cap (e.g., 30%): Using index funds like MIDCAP 150, potentially supplemented by a well-regarded actively managed fund if desired (though the core philosophy leans passive here too).

•Small-Cap (e.g., 30%): Primarily through carefully selected actively managed small-cap funds, given their potential to outperform passive strategies in this segment.

•International Equity (e.g., 10%): Gaining exposure to global markets, often the US market, through index funds or ETFs tracking indices like the NASDAQ 100 or S&P 500.

This specific 30/30/30/10 split is just an example; your own allocation should reflect your individual circumstances. The key principle is diversification to reduce risk – ensuring that poor performance in one segment doesn’t disproportionately impact your overall portfolio. Establishing this split provides a clear roadmap, prevents emotional decisions driven by market sentiment towards a particular segment, and helps manage risk effectively. Remember that this allocation isn’t static; it should be reviewed and potentially adjusted periodically (e.g., every few years) to align with changes in your life circumstances, risk appetite, or long-term goals.

Rule 8: Use SIPs for Mutual Fund Investments to Automate Investing

Consistency is paramount in long-term investing. Regularly investing a fixed amount, regardless of market conditions, is one of the most effective ways to build wealth over time. However, manually making investments every month requires discipline and can be susceptible to procrastination or emotional decision-making (e.g., hesitating to invest when markets are down).

Systematic Investment Plans (SIPs) offer a powerful solution by automating the investment process for mutual funds. An SIP allows you to invest a predetermined amount in your chosen mutual funds at regular intervals (usually monthly). The amount is automatically debited from your bank account and invested, ensuring you stay disciplined without needing active intervention.

This automation brings several benefits. Firstly, it enforces discipline, removing the temptation to time the market or skip investments during volatile periods. Secondly, SIPs facilitate rupee cost averaging. When markets are down, your fixed investment amount buys more units; when markets are up, it buys fewer units. Over time, this averages out your purchase cost per unit, potentially reducing the impact of market volatility on your overall investment.

Setting up SIPs is typically straightforward through online investment platforms or directly with fund houses. You choose the funds, the amount, the frequency, and the date, and the system handles the rest. This makes investing accessible even for beginners, allowing you to start with small amounts and gradually increase contributions as your income grows. While the source material notes that SIPs can now also be set up for ETFs through some platforms, they remain the most common and convenient way to automate investments in traditional mutual funds (both index and actively managed).

By leveraging SIPs, you instill discipline, benefit from rupee cost averaging, and make consistent investing a seamless part of your financial routine, freeing up your time and mental energy.

Rule 9: Do NOT Sell

Perhaps one of the most challenging rules to follow, yet one of the most critical for long-term wealth creation, is to resist the urge to sell your investments, especially during market downturns or periods of volatility. Human psychology often works against us here; fear prompts selling when prices fall (locking in losses), and greed might tempt profit-taking too early (missing out on future growth).

Selling investments prematurely disrupts the powerful engine of compounding. Every time you sell, you interrupt the process where your returns generate further returns. Furthermore, selling often triggers transaction costs and, more significantly, capital gains taxes, both of which reduce the net amount available for reinvestment or future growth.

Adopting a long-term perspective is key. Understand that market corrections and downturns are a normal part of the investment cycle. Historically, markets have always recovered and reached new highs over the long run. Instead of panicking, remind yourself of your long-term goals and trust the process. Staying invested allows your portfolio to recover and capture the subsequent growth.

The source material mentions the “Buy, Borrow, Die” strategy as an advanced concept to avoid selling, particularly for tax minimization. This involves holding assets long-term, borrowing against their value if funds are needed (instead of selling), and potentially passing the assets to heirs with a stepped-up cost basis, minimizing capital gains tax. While this specific strategy has complexities and isn’t suitable for everyone, the underlying principle is valuable: avoid unnecessary selling.

Of course, there might be legitimate reasons to sell, such as funding a major life goal (like buying a house), rebalancing your portfolio back to its target allocation, or if the fundamental reason for holding an investment changes drastically. In such planned scenarios, strategic selling is acceptable. However, avoid impulsive selling driven by market fear or short-term noise. Holding onto your quality investments through thick and thin is fundamental to maximizing long-term returns and achieving your Freedom Portfolio goals.

Rule 10: To Retire, Build Passive Income Sources to Keep Your Monthly Investment Amount Before Leaving Active Income

The ultimate goal of a Freedom Portfolio is often to achieve financial independence, allowing you the option to retire from active work or pursue other passions without financial constraints. A critical component of planning for this transition is ensuring you have sufficient passive income streams to cover not only your living expenses but also your ongoing investment contributions.

Simply accumulating a large corpus might not be enough if you stop contributing to it. To maintain momentum and continue benefiting from compounding even after leaving active employment, you need passive income sources that can replace your previous salary’s contribution to your investment plan (e.g., your monthly SIP amount).

Focus on building diverse passive income streams throughout your working years. Potential sources include:

•Dividends: Invest in a portfolio of quality dividend-paying stocks or dividend-focused mutual funds/ETFs. Dividends provide regular cash flow without requiring you to sell the underlying assets.

•Rental Income: Owning and managing rental properties (residential or commercial) can generate consistent monthly income, though it requires initial capital and ongoing management effort.

•Interest Income: Investments in bonds, fixed deposits, or debt mutual funds can provide regular interest payments.

•Business Income (Passive): If you build a business that can eventually run largely without your active involvement, its profits can become a significant source of passive income.

•Royalties: Income from intellectual property like books, music, or patents.

The goal is to build these streams to a level where the combined passive income comfortably covers your living expenses and allows you to continue investing the same amount you were contributing from your active income. This ensures your Freedom Portfolio continues to grow robustly even in retirement, providing long-term security and flexibility. Planning for this transition requires foresight and consistent effort in building these passive income engines alongside your core investment portfolio.

Conclusion: Your Journey to Financial Freedom

Building a Freedom Portfolio, a substantial nest egg that grants you financial independence and peace of mind, is not about uncovering secret formulas or engaging in high-stakes trading. As these 10 essential rules illustrate, the path lies in discipline, patience, and a commitment to a straightforward, long-term, passive investment strategy. By avoiding common pitfalls like market timing, emotional decision-making, and high-cost products, and instead focusing on consistent contributions, diversification through low-cost index funds (complemented by selective active management where appropriate, like in small-caps), and tuning out the short-term noise, you empower your wealth to grow steadily over time.

Embrace the power of compounding, automate your investments through SIPs, establish a clear asset allocation, and resist the urge to sell unnecessarily. Crucially, plan for the long game by building passive income streams that can sustain your lifestyle and investment contributions even after you step away from active income. This journey requires commitment, but the principles are accessible to everyone. By adhering to these rules, you can navigate the complexities of the investment world with confidence and build a portfolio that truly sets you free.