Achieving financial freedom often seems like a complex puzzle, requiring intricate knowledge of stock picking, market timing, and constant monitoring. However, what if there was a simpler, more passive way to build substantial wealth?

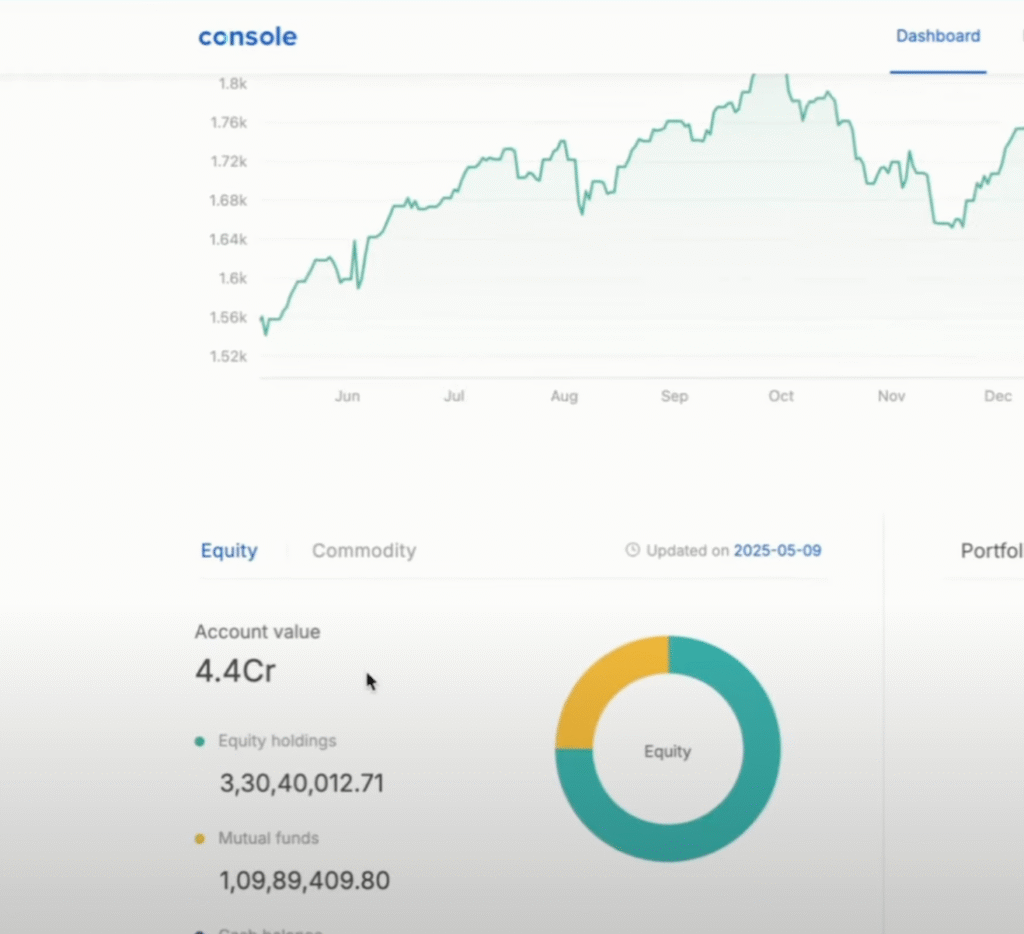

This guide explores a proven strategy centered around index investing – a method that allowed for the creation of a ₹4 Crore+ investment portfolio for Rishabh Dev without the stress of active trading or chasing elusive hot tips.

Many believe that significant wealth accumulation necessitates high-risk strategies or dedicating countless hours to market analysis. This narrative often discourages beginners and even experienced individuals from pursuing their financial goals effectively. Index investing challenges this notion by offering a straightforward, disciplined approach that harnesses the power of the broader market through low-cost, diversified funds.

This article breaks down the principles, specific steps taken, and mindset required to build a substantial portfolio using only simple index funds. Whether you’re a novice investor just starting or an experienced one looking for a less stressful path to wealth, discover how embracing ‘boring’ can be beautiful – and incredibly effective – in the world of investing. We’ll delve into the specific index funds used, the allocation strategy, and the long-term perspective that underpins this successful journey towards financial independence.

The Power of Simplicity: Why Index Investing?

In a world saturated with financial advice often pushing complex products and active trading strategies, the elegance of index investing lies in its simplicity and proven effectiveness. Why choose this path when countless alternatives promise quicker riches? The core philosophy rests on a few fundamental truths about markets and investor behaviour.

Firstly, index investing acknowledges the difficulty, bordering on impossibility, of consistently picking winning stocks or timing the market perfectly over the long term. Decades of market data show that the vast majority of actively managed funds fail to outperform their benchmark indices after accounting for fees. Instead of trying to beat the market, index investing aims to be the market, capturing its overall growth trajectory.

Secondly, diversification is inherent in index funds. By investing in a broad market index, such as the Nifty 50 or Nifty Midcap 150, you gain exposure to a diverse range of companies across various sectors. This diversification significantly reduces the risk associated with the poor performance of any single stock. If one company falters, its impact on your overall portfolio is cushioned by the performance of others.

Thirdly, index funds are typically characterised by significantly lower costs.

Active fund managers charge higher fees (expense ratios) to cover research, trading, and management costs. Index funds, being passively managed, simply replicate an index, resulting in significantly lower expense ratios. Over the decades, these seemingly small cost differences compound dramatically, leaving substantially more wealth in the investor’s pocket.

Finally, the passive nature of index investing removes emotional decision-making from the equation. Market volatility often tempts investors to buy high during euphoria and sell low during panic. Index investing encourages a disciplined, long-term approach – consistently investing regardless of market noise and staying invested through ups and downs, allowing the power of compounding to work its magic.

Deconstructing the ₹4 Crore Portfolio: The Index Breakdown

Building a substantial portfolio like the ₹4 Crore example requires a clear allocation strategy across different market segments. While the exact percentages may evolve, the foundation lies in diversification across domestic large-cap, mid-cap, and potentially next 50 stocks, along with international exposure and potentially other asset classes like gold or silver for further diversification.

•Core Domestic Equity: A significant portion is typically allocated to broad Indian market indices.

•Nifty 50: Represents the 50 largest, most liquid Indian companies, forming the backbone of many portfolios for stable, large-cap exposure.

•Nifty Midcap 150: Captures the growth potential of 150 mid-sized companies. Historically, this segment has offered higher growth than large-caps, albeit with higher volatility. This was highlighted as the largest holding in the example portfolio, indicating a belief in the long-term growth story of Indian mid-caps.

•Nifty Next 50: Includes companies ranking 51-100 by market capitalization, offering a blend between large-cap stability and mid-cap growth potential.

•International Diversification: Investing solely in one country carries inherent risks. Adding exposure to international markets, such as the US, provides geographical diversification and access to global growth engines.

•US Index (e.g., NASDAQ 100 or S&P 500): Investing in a US index fund or ETF provides exposure to leading global companies, particularly in technology (NASDAQ 100) or the broader US economy (S&P 500).

•Other Asset Classes: Depending on risk appetite and market views, diversification might extend to other assets.

•Gold/Silver Index: Precious metals often act as a hedge against inflation and market uncertainty, providing a potential buffer during equity downturns.

The specific allocation percentages across these indices depend on individual risk tolerance, investment horizon, and financial goals. However, the principle remains consistent: build a diversified portfolio across different market caps and geographies using low-cost index funds.

Index Funds vs. ETFs: Making the Right Choice

Once you decide on the indices, the next step is choosing the investment vehicle: traditional index mutual funds or Exchange-Traded Funds (ETFs). Both aim to replicate the performance of a specific index, but they differ in structure, trading, and sometimes cost.

•Index Mutual Funds:

•Purchased and redeemed directly from the Asset Management Company (AMC) at the Net Asset Value (NAV) calculated at the end of the trading day.

•Often easier for setting up Systematic Investment Plans (SIPs).

•May have slightly higher expense ratios than ETFs in some cases, but the gap is narrowing.

•Exchange-Traded Funds (ETFs):

•Traded like individual stocks on stock exchanges throughout the trading day at prevailing market prices.

•Require a demat and trading account.

•Can sometimes offer lower expense ratios.

•Prices can deviate slightly from the underlying NAV during the day (premium/discount).

•Potential brokerage costs apply to buying/selling.

Key Considerations:

•Expense Ratio & Tracking Error: Lower is generally better for both. Tracking error measures how closely the fund follows its benchmark index. Look for funds with consistently low tracking errors.

•Liquidity (for ETFs): Ensure the ETF has sufficient trading volume to allow easy buying and selling without significant price impact.

•Ease of Investment: Index funds might be simpler for beginners or those preferring automated SIPs without managing a demat account.

•Fund Houses: Choose reputable fund houses with a good track record of managing index funds efficiently.

The choice between index funds and ETFs often comes down to personal preference, cost considerations, and investment style. Both are effective tools for implementing an index investing strategy.

The Long Game: Strategy and Mindset

Building a multi-crore portfolio through index investing isn’t an overnight miracle; it’s a marathon, not a sprint. The strategy’s success hinges critically on adopting the right long-term mindset and maintaining discipline through various market cycles.

•Embrace Long-Term Compounding: The real magic happens over decades. Consistently investing and reinvesting dividends allows your money to compound, generating exponential growth over time. Resist the urge to chase short-term gains.

•Stay Disciplined: Stick to your investment plan, especially during market downturns. Volatility is normal. Selling in panic locks in losses, while staying invested allows your portfolio to recover and capture subsequent gains. Regular, automated investments (like SIPs) help maintain discipline.

•Manage Expectations: While historical data can provide context (like the 12% CAGR scenarios mentioned), future returns are not guaranteed. Focus on the process and long-term trends rather than fixating on specific year-to-year returns.

•Periodic Rebalancing: Over time, different asset classes will grow at different rates, potentially skewing your initial allocation. Periodically (e.g., annually) rebalance your portfolio by selling some of the outperformers and buying more of the underperformers to return to your target allocation. This enforces a “buy low, sell high” discipline.

•Ignore the Noise: Financial media often thrives on hype and fear. Stick to your long-term strategy and avoid making impulsive decisions based on headlines or market predictions.

The beauty of index investing, often described as ‘boring’, is precisely its strength. It removes the need for constant monitoring, stressful decisions, and attempts to outsmart the market. It’s a strategy built on patience, discipline, and faith in the long-term growth of diversified markets.

Conclusion: Your Path to Financial Freedom

Building a ₹4 Crore portfolio, or achieving any significant financial goal, is attainable through the disciplined application of index investing. By focusing on broad market exposure, low costs, diversification, and a long-term perspective, you can harness the power of compounding without the complexities and stresses of active trading.

This approach demystifies wealth creation, making it accessible to anyone willing to commit to a simple, consistent strategy. Remember the key principles: diversify across asset classes and geographies using low-cost index funds or ETFs, stay invested for the long haul, maintain discipline through market cycles, and let the market work for you. The journey to financial freedom might be simpler than you think.

Leave a Reply